Smartkem, Inc. Signs LOI with Jericho Energy Ventures to Build U.S. AI Infrastructure Using Organic Semiconductor Technology

Smartkem, Inc. Signs LOI with Jericho Energy Ventures to Build U.S. AI Infrastructure Using Organic Semiconductor Technology

Smartkem, Inc. (Nasdaq: SMTK), ("Smartkem"), a company developing a new class of organic semiconductor technology, announced that it has signed a non-binding Letter of Intent ("LOI") with Jericho Energy Ventures Inc. (TSX-V: JEV, OTC: JROOF) ("Jericho" or "JEV"), an energy innovation company, for a proposed all-stock business combination (the "Proposed Transaction"). If completed, the Proposed Transaction would establish a U.S.-owned and controlled AI infrastructure company, integrating low-cost domestic energy with advanced semiconductor packaging and materials to support the surging demand for AI compute capacity.

AI Infrastructure at the Core

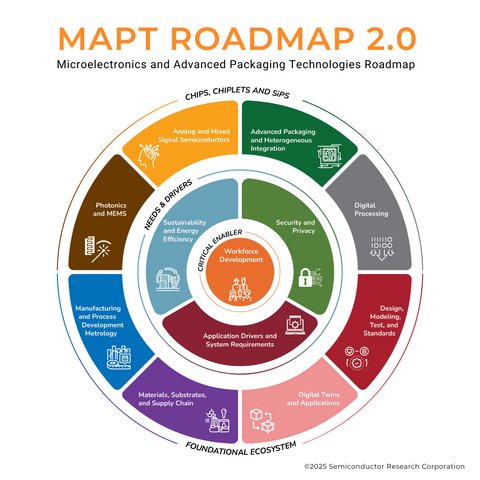

JEV is positioned at the intersection of energy and AI, leveraging its high-capacity energy framework, renewable innovation, and clean hydrogen technologies to provide resilient, low-cost power for AI data centers. The contemplated transaction would integrate Smartkem's patented organic semiconductor platform into Jericho's infrastructure to accelerate:

- Energy-efficient AI data centers engineered for next-generation workloads

- Advanced AI chip packaging that reduces power consumption and heat

- Low-power optical data transmission to enable faster interconnects

- Conformable sensors for environmental monitoring and operational resilience

Leadership Commentary

"This proposed transaction positions Smartkem's technology at the center of the largest technology build-out of our era," said Ian Jenks, Chairman and CEO of Smartkem. "We believe this combination provides the pathway for our patented materials to reach their full commercial potential inside next-generation AI infrastructure."

"AI compute growth is driving unprecedented demand for U.S. power and infrastructure," said Brian Williamson, CEO of Jericho Energy Ventures. "By combining JEV's scalable energy platform with Smartkem's semiconductor breakthroughs, we can deliver a new generation of faster, cleaner, and more resilient AI data centers."

"Together, JEV and Smartkem are developing a unified U.S. platform for AI data centers that pairs energy resilience with advanced semiconductors, a vertically integrated strategy aimed at driving sustainable growth and creating value for shareholders," said Anthony Amato, Strategic Advisor to Smartkem.

Proposed Transaction Highlights Include:

- Vertical Integration: Creates a fully integrated platform spanning energy supply and AI data center infrastructure.

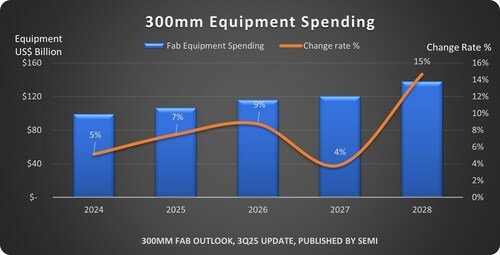

- High-Growth Market Exposure: Positions the combined company to capitalize on the high-growth forecast of U.S. power demand for AI data centers.

- Complementary Innovation: Leverages JEV's scalable energy and infrastructure expertise with Smartkem's patented organic semiconductor materials and OTFT technologies.

- Enhanced Data Center Efficiency: Enables low-power optical data transmission, advanced AI chip packaging, and conformable sensor arrays for environmental monitoring.

- U.S.-Owned & Controlled: Ensures strategic technology assets are developed, deployed, and scaled under U.S. ownership for global AI infrastructure partners.

- Leadership Synergies: Combines two experienced management teams focused on commercializing disruptive innovations at scale.

Terms of the Proposed Transaction

Under the LOI, the Proposed Transaction would be structured as an all-stock business combination, effected through either a share exchange or statutory merger, pursuant to which Smartkem would be the surviving legal entity and would continue as a publicly listed company on The Nasdaq Stock Market ("Nasdaq") (such surviving company, the "Combined Company"). Upon the closing of the Proposed Transaction, Jericho stockholders would own 65% and Smartkem stockholders prior to the Proposed Transaction would own 35% of the fully diluted issued and outstanding equity securities of the Combined Company, subject to adjustment in certain circumstances.

Brian Williamson, the current chief executive officer of Jericho, would become the chief executive officer of the Combined Company, and the board of directors of the Combined Company would be reconstituted to include a majority of members designated by Jericho, subject to compliance with applicable requirements of Nasdaq and the Securities and Exchange Commission.

The LOI is non-binding, and there can be no assurance that Smartkem and Jericho will ultimately enter into a definitive agreement for the Proposed Transaction, that the Proposed Transaction will be consummated, or as to the timing or ultimate terms of any Proposed Transaction that may occur. Both Smartkem and Jericho will need significant additional capital to complete the negotiation of the Proposed Transaction, obtain any required stockholder approvals and ultimately complete the Proposed Transaction. The closing of the Proposed Transaction would be subject to significant closing conditions, including the negotiation of the definitive agreement, the satisfactory completion of due diligence, required board and stockholder approvals, and approval of continued listing by Nasdaq.

In the LOI, Smartkem and Jericho have agreed to a 60-day exclusivity period to negotiate the terms of a definitive agreement, which exclusivity period is terminable by either party under certain circumstances including, in the case of Jericho, if Smartkem does not purchase Jericho common shares having a value of at least US$500,000 on or prior to November 30, 2025. So long as the LOI is still in effect, upon the earlier of (i) Smartkem's chief financial officer's good faith determination that Smartkem has regained compliance with Nasdaq's minimum stockholders' equity requirement and (ii) Smartkem's issuance of securities (including upon exercise of outstanding convertible securities) for aggregate gross proceeds of not less than $5,000,000, Smartkem will purchase from treasury Jericho common shares in an amount equal to the greater of (a) $500,000 and (b) 10% of the gross proceeds of such issuances, subject to a cap of $1,000,000. There can be no assurance that the circumstances necessary for Smartkem to satisfy the requirements for completion of the investment will occur.